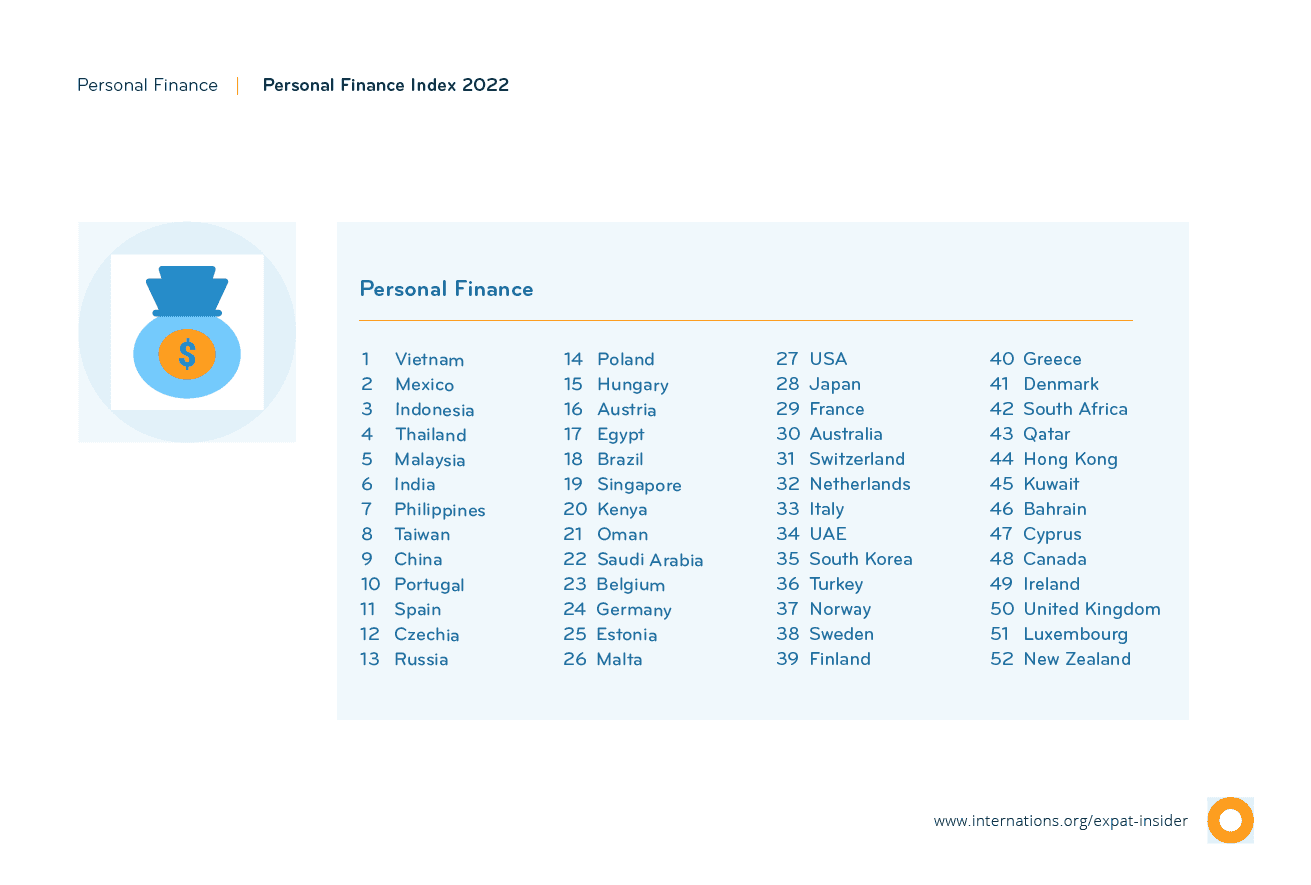

Where Expats’ Finances Go a Long Way (and Where They Don’t)

Asian destinations are overrepresented in the top 10. European countries occupy the bottom — though the worst-ranking country is found at the opposite end of the world.

Top Findings

- Eight of the top 10 destinations are located in Asia.

- Four of the bottom 10 countries are in Europe, but New Zealand ranks last.

- In #1 Vietnam, 8% say they have an income of more than 250,000 USD a year (vs. 3% globally).

- Expats in #2 Mexico and #3 Indonesia highlight the affordable cost of living.

- #44 Hong Kong is the only Asian destination in the bottom 10.

Methodology

The Personal Finance Index of the Expat Insider 2022 survey includes 52 destinations around the world, with a minimum sample size of 50 respondents each. The index is based on three factors: satisfaction with the financial situation, general cost of living, and whether a respondent’s disposable household income is enough to lead a comfortable life.

#1 Vietnam: Great Value for Expats’ Money

Vietnam ranks at the top of the Personal Finance Index, placing first across all three factors. Four in five expats in Vietnam (80%) rate the cost of living positively, compared to 45% globally. Over three times the global average even consider it very good (45% vs. 14% globally). Expats are happy with their financial situation (79% vs. 60% globally), nearly two in five (39%) even completely so (vs. 22% globally).

Three out of four expats (75%) say that their disposable household income is more than enough to live a comfortable life in Vietnam (vs. 45% globally). Altogether, 92% think that they have enough or more than enough, 20 percentage points above the global average of 72%. “I live comfortably on a limited income,” one expat from the US says, and a Japanese expat praises Vietnam for its “cheap living and high quality of life”.

Despite these results, financial reasons do not stand out as a main motivation for moving to Vietnam (3% vs. 2% globally). Instead, expats’ jobs remain a driving force (44% vs. 36% globally), while 9% were looking for a personal challenge (vs. 5% globally), and 8% simply wanted to live in this particular country (vs. 4% globally). However, there is another aspect that might explain Vietnam’s high ranking in the Personal Finance Index: 8% say that they earn more than 250,000 USD annually (vs. 3% globally).

#2 Mexico: An Expat Favorite

Ranking second in the Personal Finance Index and first overall, Mexico is a favorite among survey respondents. More than three-quarters (77%) are generally happy with their financial situation in Mexico (vs. 60% globally) — 38% even completely so (vs. 22% globally).

A similar share (77%) rate the cost of living positively, while only 45% globally say the same. More than a third (34%) are even very happy with the cost of living in Mexico (vs. 14% globally). An expat from the US praises the “variety and affordability” and for an Italian expat, “the cost of living and the weather” are clear upsides to life there. When it comes to their disposable household income, 67% agree that it is more than enough to live comfortably (vs. 45% globally). In total, nine in ten expats in Mexico (90%) find their disposable household income to be enough or more than enough (vs. 72% globally).

While only 15% say that they earn more than 100,000 USD annually (significantly less than the global average of 21%), an above-average share of working expats in Mexico are top managers (21% vs. 12% globally). That being said, only 55% are doing paid work, compared to 70% globally. Instead, the share of retired people is three times the global average (30% vs. 10%).

#3 Indonesia: Make the Most Out of Your Money

Indonesia (3rd), which places 2nd out of 52 countries overall, also lands in the top 3 of the Personal Finance Index. Nearly three-quarters of expats there (74%) rate their financial situation positively (vs. 60% globally). A similar share (73%) is happy with the cost of living in Indonesia (vs. 45% globally). Three in ten (30%) are even very happy with it (vs. 14% globally).

For the majority, their disposable household income is more than enough to lead a comfortable life (64% vs. 45% globally). In total, 87% say that they have enough or more than enough (vs. 72% globally). One expat from South Korea finds that Indonesia offers “great opportunities for saving with low living expenses”.

Expats in Indonesia are more likely to have moved abroad for job-related reasons than the global average (49% vs. 36% globally). For many of them, this move pays off: 29% of expats working in Indonesia are top managers and executives (vs. 12% globally), while twice the global average have a business of their own (14% vs. 7% globally). When it comes to annual incomes, 7% even say that they make more than 250,000 USD (vs. 3% globally).

High Cost of Living in the Bottom 3

Expats’ money does not go a long way in New Zealand (52nd), Luxembourg (51st), and the UK (50th).

New Zealand, which occupies the last place in the Personal Finance Index, also ranks second to last overall. Expats are particularly unhappy with the cost of living: 75% rate it negatively (vs. 35% globally), and more than one-third (34%) even find it very bad (vs. 8% globally). The country was hit hard by inflation in recent years: according to Consumer Price Index (CPI) predictions, inflation has skyrocketed above 7% and is expected to rise even further.

“The cost of living is too high here in comparison to the salaries,” says one survey respondent from Botswana. And another expat from India points out the “growing divide between the rich and poor”.

Almost half (49%) say that their disposable household income is not enough to lead a comfortable life, compared to 28% globally, ranking New Zealand last for this factor. Unsurprisingly, 30% are unhappy with their financial situation, 14% even completely so (vs. a global average of 21% and 8%, respectively).

The cost of living is also a major concern among expats in Luxembourg: 71% rate this factor negatively, more than twice the global average of 35%. A quarter (25%) even give it the worst possible rating (vs. 8% globally). An EU Commission survey reached the same conclusion: according to their results, the cost of living as well as housing were the main concerns of people living in Luxembourg.

“The cost of living is out of reach for all except those willing to house share or those who make well into six figures,” an expat from the US points out. When it comes to disposable household incomes, 31% say that it is not enough to lead a comfortable life (vs. 28% globally). Despite all this, the share of expats in Luxembourg who are generally satisfied with their financial situation is close to the global average (61% vs. 60%).

Survey respondents in the United Kingdom are less satisfied with their financial situation (50% happy vs. 60% globally). More than half (54%) also rate the cost of living negatively (vs. 35% globally), and expats in the UK are twice as likely to give it the worst possible rating (16% vs. 8% globally). “The cost of living is getting higher every year,” says an expat from Turkey, and a survey respondent from Iran admits that “the take-home salary is low and saving money is difficult.” More than a third (35%) share that their disposable household income is not enough to lead a comfortable life (vs. 28% globally). Inflation has been on the rise for a while in the UK, due to rising natural gas prices and supply-chain shortages but is expected to reach a new peak in 2022.

Trends in the Top 10

- Vietnam

- Mexico

- Indonesia

- Thailand

- Malaysia

- India

- Philippines

- Taiwan

- China

- Portugal

In 2022, Asian destinations dominate the top 10 of the Personal Finance Index with Vietnam (1st), Indonesia (3rd), Thailand (4th), Malaysia (5th), India (6th), the Philippines (7th), Taiwan (8th), and China (9th). Mexico (2nd) and Portugal (10th) are the clear exceptions to this rule. All eight Asian destinations rank in the top 10 regarding their disposable household income being enough for a comfortable life. However, the satisfaction with the general cost of living as well as the financial situation varies a little.

That being said, only China and India have a high share of big earners: 21% of expats in China and 15% in India have an income of more than 150,000 USD per year. Survey respondents in Taiwan certainly do not fall into this category: for 65% of them, it’s less than 50,000 USD.

The Philippines has the highest share of expats moving for financial reasons, with 8% saying as much (vs. 2% globally). In Indonesia, not a single respondent named this as their main motivation.

Trends in the Bottom 10

- Qatar

- Hong Kong

- Kuwait

- Bahrain

- Cyprus

- Canada

- Ireland

- United Kingdom

- Luxembourg

- New Zealand

The bottom 10 include four destinations in Europe — Luxembourg (51st), the UK (50th), Ireland (49th), and Cyprus (47th) — and three in the Middle East — Bahrain (46th), Kuwait (45th), and Qatar (43rd).

Expats in Luxembourg, the UK, and Ireland particularly struggle with the high cost of living: 71%, 54%, and 59%, respectively, are dissatisfied with this factor (vs. 35% globally). Expats in Cyprus, on the other hand, are unhappy with their disposable household income: 44% say that it is not enough to live comfortably (vs. 28% globally). Four in five (80%) also have a gross income of less than 50,000 USD per year, compared to 53% globally.

The disposable household income is an issue for expats in Bahrain and Qatar, too: only 37% and 34%, respectively, have more than enough for a comfortable life (vs. 45% globally). Bahrain also ranks second to last for expats’ satisfaction with their financial situation (with 25% rating it negatively), while expats in Kuwait are particularly unhappy with the cost of living there (54% say as much).

Interestingly, all three of these countries stand out with an above-average share of respondents for whom financial reasons were the main motivation for moving abroad. In Bahrain and Qatar, 7% each name this as their main reason, while 10% in Kuwait say the same (vs. 2% globally). However, annual incomes are largely on par or even below the global average.

Hong Kong (44th), Canada (48th), and New Zealand (52nd) are the only destinations representing their respective region in the bottom 10. While its Asian neighbors perform rather well in the Personal Finance Index, expats in Hong Kong struggle with the high cost of living (68% unhappy vs. 35% globally). Canada underperforms in all of the individual factors of the index, and most notably in regard to household incomes (38% negative ratings vs. 28% globally).

Further Reading

- Full PDF Report

- MSN — Inflation predicted to hit ‘hellish’ level when CPI figures unveiled this week

- Luxembourg Times — Housing, cost of living main concerns in Luxembourg

- The New York Times — ‘What Are We Supposed to Cut Back?’ Britons at Risk as Fuel Bills Skyrocket

- Vietnam Offers Easy Finances but Poor Administration

- Mexico Is the World’s Best Country for Expats

- Indonesia Makes It Easy to Settled In & Feel at Home

- Expats Struggle with Their Finances in the United Kingdom

Download

Contact

Kathrin Chudoba

Editor in chief

Where Expats’ Finances Go a Long Way (and Where They Don’t)

Asian destinations are overrepresented in the top 10. European countries occupy the bottom — though the worst-ranking country is found at the opposite end of the world.

Top Findings

- Eight of the top 10 destinations are located in Asia.

- Four of the bottom 10 countries are in Europe, but New Zealand ranks last.

- In #1 Vietnam, 8% say they have an income of more than 250,000 USD a year (vs. 3% globally).

- Expats in #2 Mexico and #3 Indonesia highlight the affordable cost of living.

- #44 Hong Kong is the only Asian destination in the bottom 10.

Methodology

The Personal Finance Index of the Expat Insider 2022 survey includes 52 destinations around the world, with a minimum sample size of 50 respondents each. The index is based on three factors: satisfaction with the financial situation, general cost of living, and whether a respondent’s disposable household income is enough to lead a comfortable life.

#1 Vietnam: Great Value for Expats’ Money

Vietnam ranks at the top of the Personal Finance Index, placing first across all three factors. Four in five expats in Vietnam (80%) rate the cost of living positively, compared to 45% globally. Over three times the global average even consider it very good (45% vs. 14% globally). Expats are happy with their financial situation (79% vs. 60% globally), nearly two in five (39%) even completely so (vs. 22% globally).

Three out of four expats (75%) say that their disposable household income is more than enough to live a comfortable life in Vietnam (vs. 45% globally). Altogether, 92% think that they have enough or more than enough, 20 percentage points above the global average of 72%. “I live comfortably on a limited income,” one expat from the US says, and a Japanese expat praises Vietnam for its “cheap living and high quality of life”.

Despite these results, financial reasons do not stand out as a main motivation for moving to Vietnam (3% vs. 2% globally). Instead, expats’ jobs remain a driving force (44% vs. 36% globally), while 9% were looking for a personal challenge (vs. 5% globally), and 8% simply wanted to live in this particular country (vs. 4% globally). However, there is another aspect that might explain Vietnam’s high ranking in the Personal Finance Index: 8% say that they earn more than 250,000 USD annually (vs. 3% globally).

#2 Mexico: An Expat Favorite

Ranking second in the Personal Finance Index and first overall, Mexico is a favorite among survey respondents. More than three-quarters (77%) are generally happy with their financial situation in Mexico (vs. 60% globally) — 38% even completely so (vs. 22% globally).

A similar share (77%) rate the cost of living positively, while only 45% globally say the same. More than a third (34%) are even very happy with the cost of living in Mexico (vs. 14% globally). An expat from the US praises the “variety and affordability” and for an Italian expat, “the cost of living and the weather” are clear upsides to life there. When it comes to their disposable household income, 67% agree that it is more than enough to live comfortably (vs. 45% globally). In total, nine in ten expats in Mexico (90%) find their disposable household income to be enough or more than enough (vs. 72% globally).

While only 15% say that they earn more than 100,000 USD annually (significantly less than the global average of 21%), an above-average share of working expats in Mexico are top managers (21% vs. 12% globally). That being said, only 55% are doing paid work, compared to 70% globally. Instead, the share of retired people is three times the global average (30% vs. 10%).

#3 Indonesia: Make the Most Out of Your Money

Indonesia (3rd), which places 2nd out of 52 countries overall, also lands in the top 3 of the Personal Finance Index. Nearly three-quarters of expats there (74%) rate their financial situation positively (vs. 60% globally). A similar share (73%) is happy with the cost of living in Indonesia (vs. 45% globally). Three in ten (30%) are even very happy with it (vs. 14% globally).

For the majority, their disposable household income is more than enough to lead a comfortable life (64% vs. 45% globally). In total, 87% say that they have enough or more than enough (vs. 72% globally). One expat from South Korea finds that Indonesia offers “great opportunities for saving with low living expenses”.

Expats in Indonesia are more likely to have moved abroad for job-related reasons than the global average (49% vs. 36% globally). For many of them, this move pays off: 29% of expats working in Indonesia are top managers and executives (vs. 12% globally), while twice the global average have a business of their own (14% vs. 7% globally). When it comes to annual incomes, 7% even say that they make more than 250,000 USD (vs. 3% globally).

High Cost of Living in the Bottom 3

Expats’ money does not go a long way in New Zealand (52nd), Luxembourg (51st), and the UK (50th).

New Zealand, which occupies the last place in the Personal Finance Index, also ranks second to last overall. Expats are particularly unhappy with the cost of living: 75% rate it negatively (vs. 35% globally), and more than one-third (34%) even find it very bad (vs. 8% globally). The country was hit hard by inflation in recent years: according to Consumer Price Index (CPI) predictions, inflation has skyrocketed above 7% and is expected to rise even further.

“The cost of living is too high here in comparison to the salaries,” says one survey respondent from Botswana. And another expat from India points out the “growing divide between the rich and poor”.

Almost half (49%) say that their disposable household income is not enough to lead a comfortable life, compared to 28% globally, ranking New Zealand last for this factor. Unsurprisingly, 30% are unhappy with their financial situation, 14% even completely so (vs. a global average of 21% and 8%, respectively).

The cost of living is also a major concern among expats in Luxembourg: 71% rate this factor negatively, more than twice the global average of 35%. A quarter (25%) even give it the worst possible rating (vs. 8% globally). An EU Commission survey reached the same conclusion: according to their results, the cost of living as well as housing were the main concerns of people living in Luxembourg.

“The cost of living is out of reach for all except those willing to house share or those who make well into six figures,” an expat from the US points out. When it comes to disposable household incomes, 31% say that it is not enough to lead a comfortable life (vs. 28% globally). Despite all this, the share of expats in Luxembourg who are generally satisfied with their financial situation is close to the global average (61% vs. 60%).

Survey respondents in the United Kingdom are less satisfied with their financial situation (50% happy vs. 60% globally). More than half (54%) also rate the cost of living negatively (vs. 35% globally), and expats in the UK are twice as likely to give it the worst possible rating (16% vs. 8% globally). “The cost of living is getting higher every year,” says an expat from Turkey, and a survey respondent from Iran admits that “the take-home salary is low and saving money is difficult.” More than a third (35%) share that their disposable household income is not enough to lead a comfortable life (vs. 28% globally). Inflation has been on the rise for a while in the UK, due to rising natural gas prices and supply-chain shortages but is expected to reach a new peak in 2022.

Trends in the Top 10

- Vietnam

- Mexico

- Indonesia

- Thailand

- Malaysia

- India

- Philippines

- Taiwan

- China

- Portugal

In 2022, Asian destinations dominate the top 10 of the Personal Finance Index with Vietnam (1st), Indonesia (3rd), Thailand (4th), Malaysia (5th), India (6th), the Philippines (7th), Taiwan (8th), and China (9th). Mexico (2nd) and Portugal (10th) are the clear exceptions to this rule. All eight Asian destinations rank in the top 10 regarding their disposable household income being enough for a comfortable life. However, the satisfaction with the general cost of living as well as the financial situation varies a little.

That being said, only China and India have a high share of big earners: 21% of expats in China and 15% in India have an income of more than 150,000 USD per year. Survey respondents in Taiwan certainly do not fall into this category: for 65% of them, it’s less than 50,000 USD.

The Philippines has the highest share of expats moving for financial reasons, with 8% saying as much (vs. 2% globally). In Indonesia, not a single respondent named this as their main motivation.

Trends in the Bottom 10

- Qatar

- Hong Kong

- Kuwait

- Bahrain

- Cyprus

- Canada

- Ireland

- United Kingdom

- Luxembourg

- New Zealand

The bottom 10 include four destinations in Europe — Luxembourg (51st), the UK (50th), Ireland (49th), and Cyprus (47th) — and three in the Middle East — Bahrain (46th), Kuwait (45th), and Qatar (43rd).

Expats in Luxembourg, the UK, and Ireland particularly struggle with the high cost of living: 71%, 54%, and 59%, respectively, are dissatisfied with this factor (vs. 35% globally). Expats in Cyprus, on the other hand, are unhappy with their disposable household income: 44% say that it is not enough to live comfortably (vs. 28% globally). Four in five (80%) also have a gross income of less than 50,000 USD per year, compared to 53% globally.

The disposable household income is an issue for expats in Bahrain and Qatar, too: only 37% and 34%, respectively, have more than enough for a comfortable life (vs. 45% globally). Bahrain also ranks second to last for expats’ satisfaction with their financial situation (with 25% rating it negatively), while expats in Kuwait are particularly unhappy with the cost of living there (54% say as much).

Interestingly, all three of these countries stand out with an above-average share of respondents for whom financial reasons were the main motivation for moving abroad. In Bahrain and Qatar, 7% each name this as their main reason, while 10% in Kuwait say the same (vs. 2% globally). However, annual incomes are largely on par or even below the global average.

Hong Kong (44th), Canada (48th), and New Zealand (52nd) are the only destinations representing their respective region in the bottom 10. While its Asian neighbors perform rather well in the Personal Finance Index, expats in Hong Kong struggle with the high cost of living (68% unhappy vs. 35% globally). Canada underperforms in all of the individual factors of the index, and most notably in regard to household incomes (38% negative ratings vs. 28% globally).

Further Reading

- Full PDF Report

- MSN — Inflation predicted to hit ‘hellish’ level when CPI figures unveiled this week

- Luxembourg Times — Housing, cost of living main concerns in Luxembourg

- The New York Times — ‘What Are We Supposed to Cut Back?’ Britons at Risk as Fuel Bills Skyrocket

- Vietnam Offers Easy Finances but Poor Administration

- Mexico Is the World’s Best Country for Expats

- Indonesia Makes It Easy to Settled In & Feel at Home

- Expats Struggle with Their Finances in the United Kingdom

Join InterNations

The community for expats worldwide

Download

Contact

Kathrin Chudoba

Editor in chief