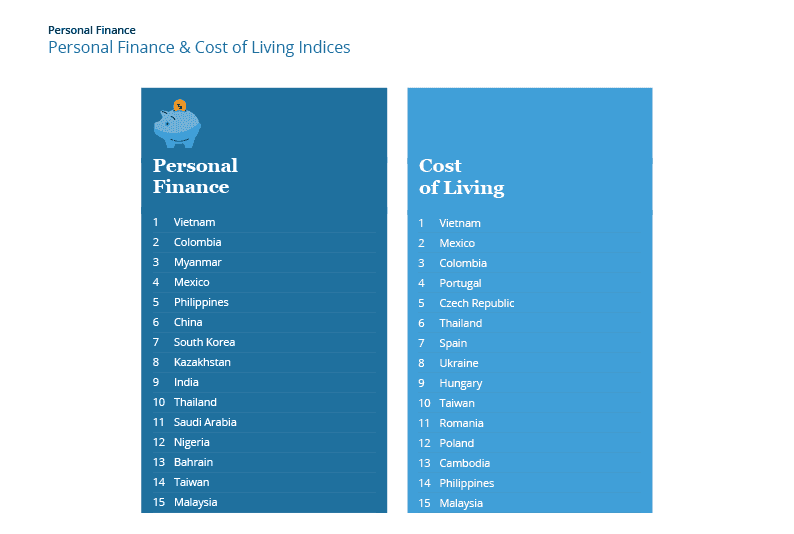

Low-Cost Locations: Where Expat Incomes Go Further

Destinations with lower living costs help expats to balance their books, while countries with weak economies tend to lead to high levels of dissatisfaction as expats struggle to get by.

- #1 Vietnam has climbed from fifth place to take the top spot in 2017.

- #2 Colombia and #3 Myanmar are new to the global top 10.

- Portugal, Nigeria, and Costa Rica make significant improvements.

- Italy, Israel, and Greece continue to trail behind.

Methodology

In the Expat Insider 2017 survey, 65 countries are listed in the Personal Finance Index. The minimum sample size for a country to be featured is 75 respondents, but nearly 50 countries have a sample size of more than 100 participants.

The Personal Finance Index is based on two rating questions with a scale of one to seven: how respondents perceive their personal financial situation and whether their disposable income is enough to cover their expenses. The first question carried double the weight when the average ratings were combined to create this index.

To give a more rounded picture of the respondents’ financial situation abroad, insights from the Cost of Living Index are included in this summary. Due to its similarity with the Personal Finance Index, however, the Cost of Living Index is not included in the overall country ranking; this prevents the financial aspects of life abroad from being overrepresented in the survey results.

Vietnam: Great Value

The Asian nation has continued its climb up the ranks: after narrowly missing the top 5 in 2014 and 2015, it came fifth in 2016, and takes the top spot in the Personal Finance Index in 2017. Almost three in ten respondents (28%) are completely satisfied with their financial situation, eleven percentage points more than the global average (17%).

Just 7% of expats in Vietnam think that their disposable household income is not enough to get by. In fact, 93% of respondents say they have enough or more than they need, significantly more than the global average of 77%. Nearly one in five (18%) even think that they have far more money at their disposal than their lifestyle requires.

Over nine in ten expats (91%) are also happy with the cost of living in Vietnam, with more than four in ten (43%) saying costs are very affordable (global average: 15%). With key cities such as Ho Chi Minh and Hanoi ranking in the middle of 2016’s Mercer Cost of Living survey, the Expat Insider 2017 survey found that almost three-quarters of expats (73%) regarded the lower cost of living as a potential benefit before making the move to Vietnam.

Colombia: Significant Improvements

While in past years Colombia has been in the middle of this index, it’s one of the countries that has improved the most in 2017, jumping 17 places to take the number two spot. Almost 80% of respondents are generally satisfied with their personal finances, with 33% saying that they couldn’t be happier — an even higher number than index winner, Vietnam.

The vast majority of expats in Colombia (86%) thinks that their disposable income is enough or more than enough to cover daily expenses abroad. However, 14% state their income isn’t sufficient; though this is significantly more than in Vietnam (7%), it’s still nine percentage points lower than the global average (23%).

With its capital city, Bogota, ranking 190th out of 209 cities in Mercer’s Cost of Living Survey, it’s no surprise that expats are happy with the fairly low cost of living in Colombia: 84% are generally satisfied, and an impressive 43% of respondents say that life in Colombia is very affordable.

The financial benefits of living in Colombia were an important motivating factor when relocating, with 36% of expats citing finances as one of their reasons for moving. In fact, over seven in ten respondents (73%) regarded the local cost of living as a potential advantage of moving to Colombia.

Myanmar: Plenty to Get By

Though it ranks third in this index, Myanmar was top of the class for one specific question: when asked whether their disposable income is enough for their daily life, a significant 67% of respondents have more than enough to cover their costs. In fact, 38% even say they have a lot more than they need, nearly four times the global average (10%). Unsurprisingly, almost three-quarters of expats say they are generally happy with their financial situation in Myanmar.

Despite Myanmar’s economic hub, Yangon, ranking in the top 40 most expensive cities in the world according to Mercer’s Cost of Living Survey 2016, 48% of respondents are generally happy with their living expenses — the same as the global average. This could be related to the above-average number of expats in Myanmar working in management positions, who may be used to a more expensive lifestyle: nearly one in three survey respondents in Myanmar (32%) describe their employment status as manager, compared to one in seven worldwide.

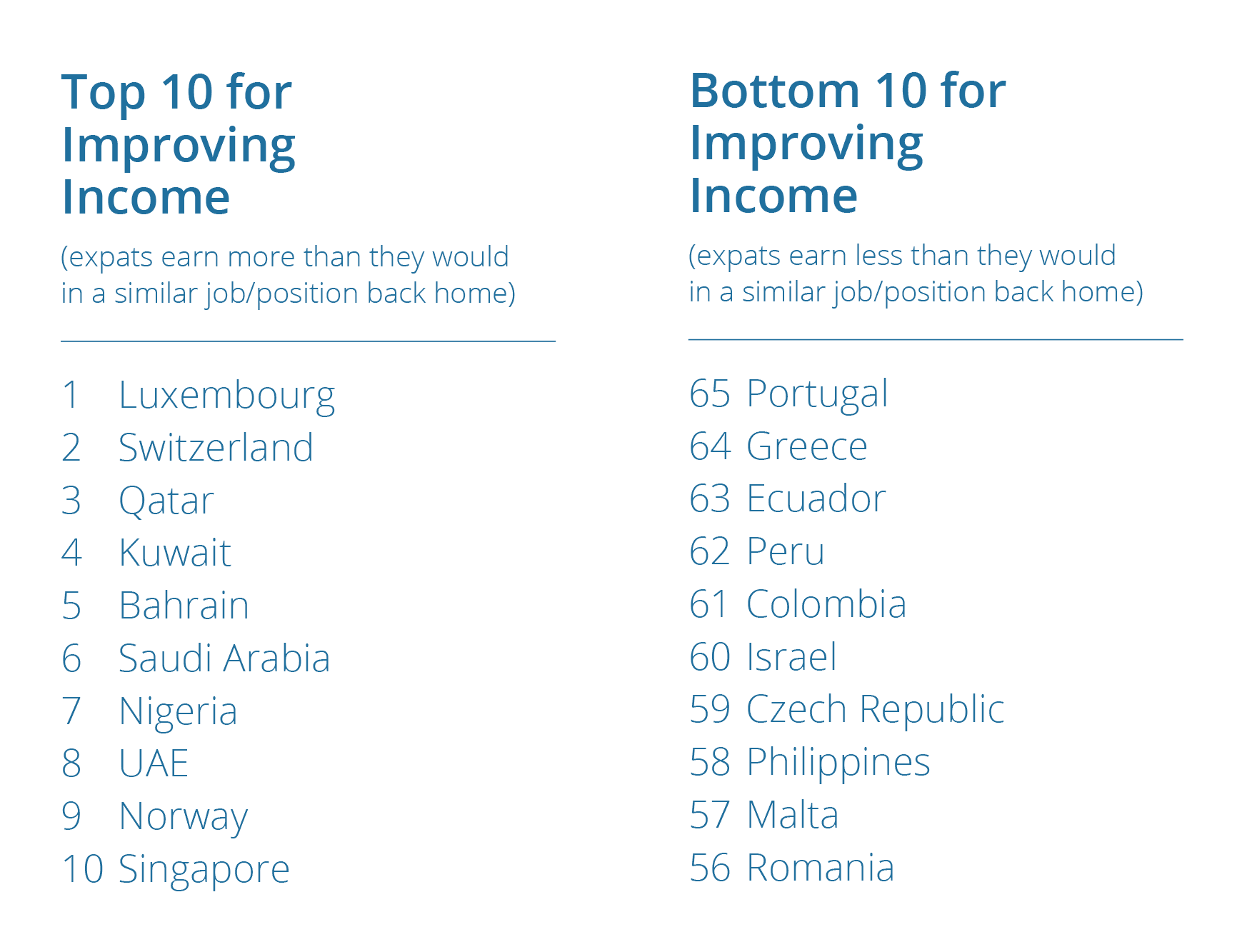

Improving Incomes

Bottom of the Pack

Trailing in the bottom 3 of the Personal Finance Index are Italy, Israel, and Greece; these countries have consistently been in the bottom 5 for the past four years with Greece coming last every year. Insufficient household income is a common theme among respondents in these countries: 36% of respondents in Italy, 45% in Israel, and half of the respondents in Greece say their household income is not enough to cover their daily expenses. In Greece, 27% even say it’s not nearly enough to get by.

Such financial challenges have led to low satisfaction ratings. While fewer than one in five expats globally (19%) aren’t satisfied with their personal finances, that percentage rises to 33% in Italy, 38% in Israel, and a significant 51% of respondents in Greece.

Winners & Losers

Two-time winner of the Personal Finance Index in 2014 and 2015, Ecuador slipped from 3rd place in the 2016 ranking to 40th in 2017. While over eight in ten expats (81%) were generally satisfied with their financial situation in 2016, only 65% of respondents say the same in 2017. The number of those who say they have more than enough to cover their expenses has dropped by 16 percentage points to 48%, and those earning a lot more than they need has reduced from 19% to 8%.

The 2016 runner-up, Ukraine, dipped to 39th place in the Personal Finance Index. While 76% said they were generally satisfied with their financial situation in 2016, this has now dropped by 13 percentage points. Similarly, Uganda slipped from the middle of the ranking to 57th place; 60% said their income was more than enough in 2016, but only 38% feel the same the following year. One in nine expats in Uganda even gives their financial situation the worst possible rating, whereas no respondents gave it this rating in 2016.

Climbing up the ranking is one of the biggest losers from the 2016 ranking, Nigeria: it has moved 20 places to take the 12th spot in the Personal Finance Index. The number of expats who have a lot more than they need has risen from 15% to 21%, and almost a third (31%) give their personal finances the best rating in 2017, compared to 19% in 2016.

While improvements across all factors have helped Costa Rica jump from 43rd in 2016 to 24th in 2017, it’s Portugal that has improved the most. While 56% respondents were generally satisfied with their finances in 2016, this figure has now increased to 63%, almost in line with the global average (64%). More importantly, the number of expats rating their financial situation negatively has dropped to one in five.

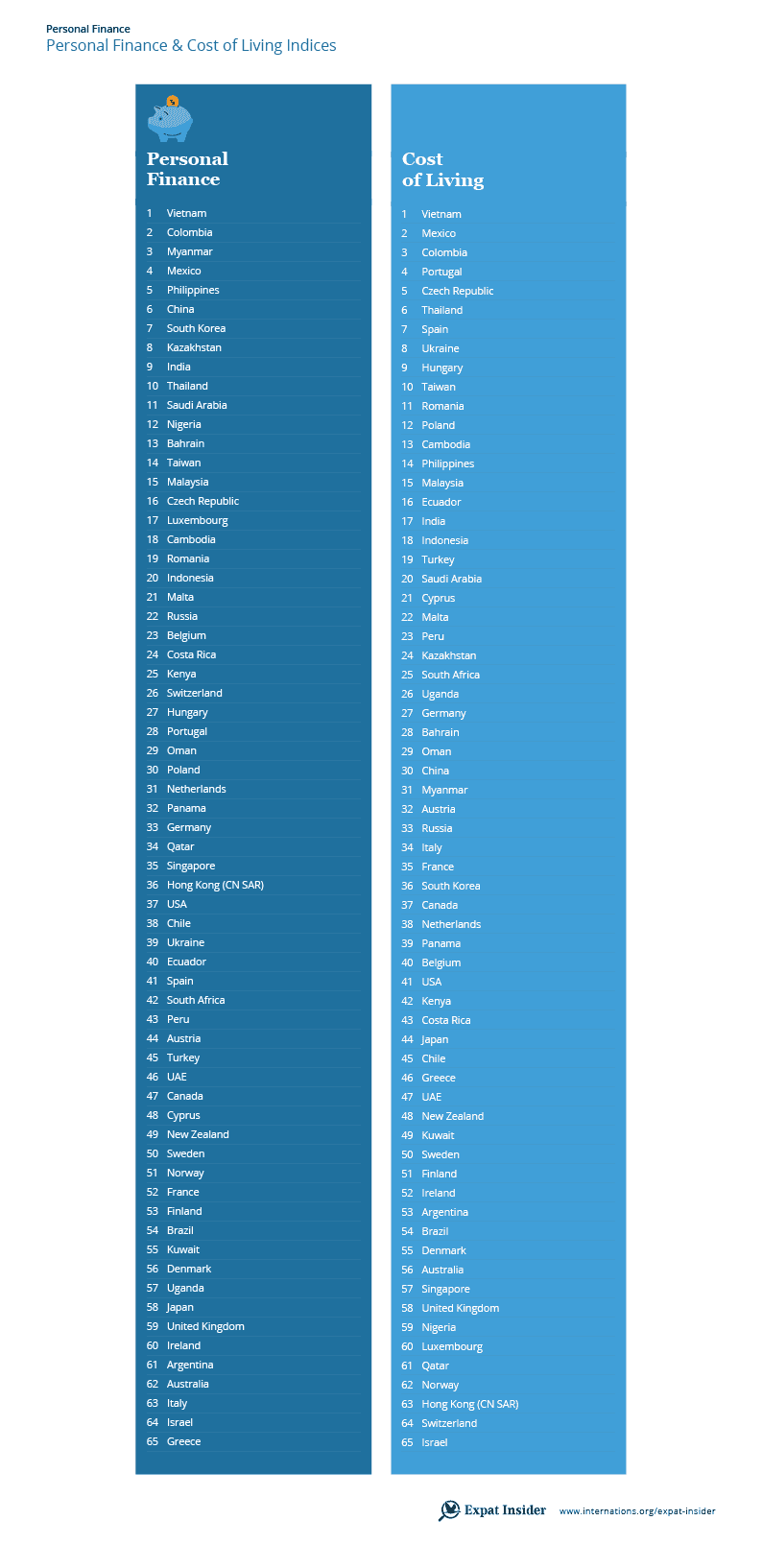

Full Ranking

Advertisement

Join InterNations

The community for expats worldwide

Download