The Best (& Worst) Cities for the Cost-Conscious Expat

Top Findings

- #1 Málaga offers the best cost of living in the world.

- Incomes go a long way in #2 Bangkok.

- #3 Alicante sees lower incomes but also low costs.

- Vancouver (#49), New York City (#48), and London (#47) are found at the bottom of the list.

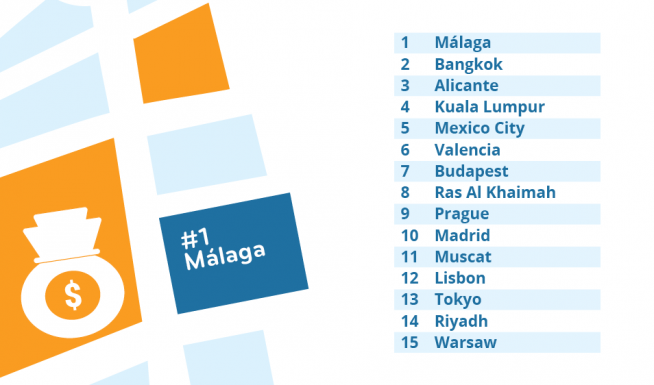

The Top 15

Methodology

The Personal Finance Index is based on three factors, which were rated on a scale of one (very bad) to seven (very good): satisfaction with the financial situation, general cost of living, and whether a respondent’s disposable household income is enough to lead a comfortable life.

To be featured in the ranking, a city had to have a minimum of 50 respondents. In 2023, 49 cities made this threshold.

Affording a Great Quality of Life in #1 Málaga

Financial reasons may not be a main motivation for expats to move to Málaga — in fact, not a single respondent there gave this answer (vs. 3% globally). However, they enjoy not only a great Quality of Life (2nd) but also some of the best cost of living in the world (1st). Close to four in five (79%) rate this factor favorably (vs. just 44% globally).

“I love the relaxed atmosphere, the cost of living, and the ability to socialise in many places,” shares a British expat. And while incomes are slightly below average — 58% say their gross yearly income is below or at 50,000 USD (vs. 53% globally) — 82% find that their disposable household income is enough or more than enough to lead a comfortable life in Málaga (vs. 73% globally).

It’s Easy to Live a Comfortable Life in #2 Bangkok

For expats in Bangkok, living expenses were an important factor when deciding on where to move (41% vs. 27% globally). And they picked well: Bangkok ranks 2nd in the Personal Finance Index. Seven in ten expats there (70%) are happy with their financial situation, a third (33%) even very much so (vs. a global 58% and 21%, respectively).

A similar share (73%) regard local living costs favorably (vs. 44% globally). “It’s a great place to live on a budget,” according to a Bangladeshi respondent. And indeed, close to two-thirds (66%) say their available income is more than enough to lead a comfortable life (vs. 44% globally).

Enjoying Low Costs in #3 Alicante

With Alicante (3rd), a second Spanish city makes it into the top 3 of the Personal Finance Index. As in Málaga, expats are quick to highlight the low cost of living (2nd), which close to four in five (78%) rate favorably (vs. 44% globally). And that’s a good thing, as also here an above-average share of 61% say their annual gross income is below or at 50,000 USD, compared to 53% globally.

All in all, two-thirds of expats in Alicante (67%) are happy with their financial situation (vs. 58% globally) — 36% even very much so (vs. 21% globally).

You Need to Tighten Your Purse Strings in the Bottom 3

Vancouver can once again be found at the bottom of the Personal Finance Index (49th), just like in 2022. Close to half the expats there (49%) find that their disposable household income does not afford them a comfortable life (vs. 27% globally), and a staggering 84% view the local cost of living negatively (vs. 35% globally). It’s a good thing then that not a single respondent in Vancouver moved there for financial reasons (vs. 3% globally).

Regularly named one of the most expensive cities worldwide, the high cost of living continues to drag down New York City. While it still ranked 42nd out of 50 cities in 2022, it now places second to last in 2023. “You need a lot of money to make it here,“ an Israeli respondent shares, pointing out how especially “rent is too expensive”. Others agree: more than double the global average give local costs a negative rating (79% vs. 35% globally). All in all, just 41% are satisfied with their financial situation in NYC, compared to 58% of expats worldwide.

London is also no stranger to the bottom of the Personal Finance Index, placing 47th out of 49 cities in 2023. Less than two in five (38%) are happy with their financial situation in the British capital, 20 percentage points less than the global average of 58%. And nearly three-quarters (74%) rate the cost of living negatively (vs. 35% globally).

Consequently, close to half (45%) find their available household income is not enough to lead a comfortable life (vs. 27% globally). Or in the words of an American respondent in London: “I think the cost of living compared to the standard of living — they just don't add up.”

Full Ranking

Further Reading

- The Best (& Worst) Cities for Expats in 2023

- Málaga: Expats’ Favorite City

- Bangkok: Affordable Housing & Excellent Healthcare

- Alicante: Where Expats Find Housing the Most Affordable

- Vancouver: Where Expats Struggle Most with Their Finances

- New York City: Expats Find a Thriving Business Culture but Can’t Afford Life

- London: Rampant High Costs Stifle Expats

- What These Countries Do for Your Finances in 2023

- Mercer: Cost of Living City Ranking 2023