What These Countries Do for Your Finances in 2023

Asian destinations perform well with top-10 positions in the Personal Finance Index, while the high cost of living remains a challenge for expats in some European countries.

Top Findings

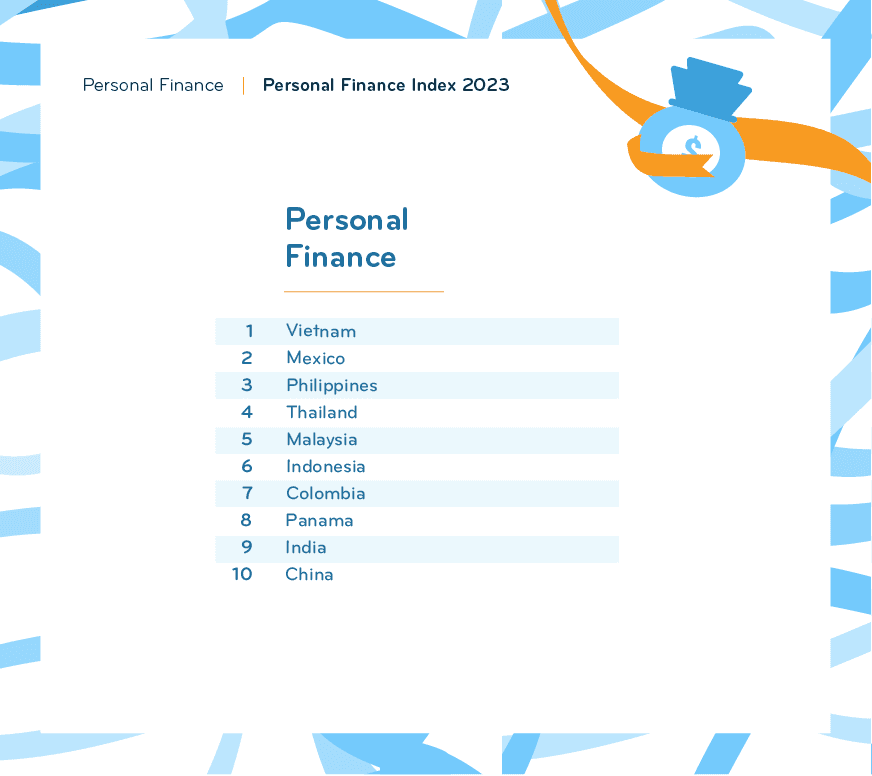

- #1 Vietnam is unbeatable; followed by #2 Mexico and #3 the Philippines.

- Seven of the top 10 destinations are in Asia.

- Overall, there are few surprises among the ten best & worst countries.

- #52 Norway is one of the biggest losers in the index.

- New Zealand (#53) and the United Kingdom (#51) round out the bottom 3.

The Top 10

Methodology

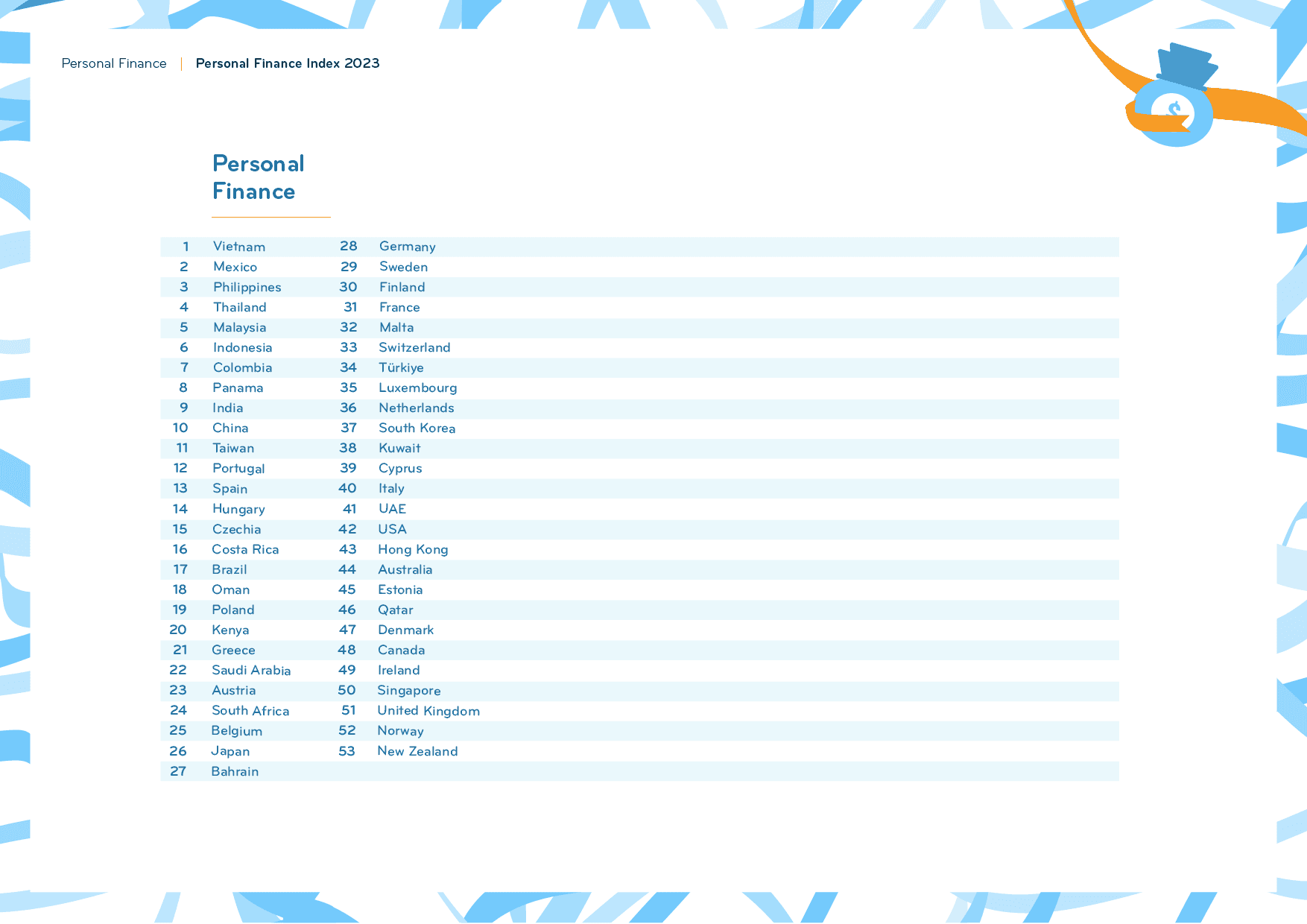

The Personal Finance Index of the Expat Insider 2023 survey includes 53 destinations around the world, with a minimum sample size of 50 respondents each. The index is based on three factors: satisfaction with the financial situation, general cost of living, and whether a respondent’s disposable household income is enough to lead a comfortable life.

#1 Vietnam: The Go-To Place for Affordable Living

Vietnam ranks 1st in the Personal Finance Index, defending its top spot from 2022. It places first for two of the index’s three factors and only just misses out on a top 3 place for the third. Over three-quarters of respondents in Vietnam (77%) rate the cost of living favorably (vs. 44% globally). More than triple the global average say it is very good (43% vs. 13%). Expats are happy with their financial situation (71% vs. 58% globally) — close to two in five (39%) even completely so (vs. 21% globally).

“What I love the most about Vietnam is the low cost of living.” – US American expat

Around seven in ten (71%) agree that their disposable household income is more than enough to lead a comfortable life (vs. 44% globally). And over a quarter (27%) even say it is a lot more than enough (vs. 6% globally).

Despite these great results, financial reasons do not stand out as the main motivation to move there (3% — the same as the global average). But almost double the global average say living expenses were an important consideration (49% vs. 27% globally). Another interesting aspect is that close to a third of those working in Vietnam (32%) are top managers / executives (vs. 12% globally).

#2 Mexico: Fully Satisfied with Their Finances

Mexico remains a favorite destination among survey respondents. The country ranks 2nd in the Personal Finance Index and comes in 1st overall. Four in five expats there (80%) are generally satisfied with their financial situation, compared to 58% globally. And close to double the global average are even completely satisfied (41% vs. 21%).

Over three in five (63%) say that their disposable household income is more than enough to lead a comfortable life in Mexico (vs. 44% globally). Another factor for Mexico’s great performance is that around seven in ten (71%) rate the cost of living favorably (vs. 44% globally). Just over double the global average agrees it is very good (28% vs. 13%). In just two words, a US American expat shares what he likes best about Mexico: “It’s affordable.”

After the general lifestyle (59%) and the climate and weather (54%), living expenses (47%) are especially important to expats in Mexico when deciding where to move to.

#3 Philippines: A Comfortable Life for Little Money

The Philippines ranks 2nd out of 53 countries overall but is a newcomer in the top 3 of the Personal Finance Index (3rd). Three-quarters of expats in the Philippines (75%) are generally satisfied with their financial situation (vs. 58% globally), and 36% even completely so (vs. 21% globally). Similarly, 74% of expats rate the cost of living favorably (vs. 44% globally). Close to four in ten (38%) even say it is very good (vs. 13% globally). “I can do fun things with my daughter without breaking the bank,” according to a Dutch expat.

Close to two-thirds of expats (66%) say that their disposable household income is more than enough to lead a comfortable life (vs. 44% globally). According to 21%, it is even a lot more than enough (vs. 6%).

Despite these results, one of the main motivations for expats to move there is for love (22% vs. 10% globally) rather than financial (5% vs. 3%) or job-related reasons (22% vs. 35%). Only around a third of expats (34%) are doing paid work (vs. 69% globally). In fact, almost half (48%) are retired (vs. 11% globally). Still, of the few that are working, 29% are top managers / executives (vs. 12% globally).

Bottom 3: Where Incomes Are Not Enough

Expats need to tighten their purse strings when they move to New Zealand (53rd), Norway (52nd), and the UK (51st).

New Zealand could not escape a last place in the Personal Finance Index in 2023, even if its overall performance did improve compared to 2022 (45th vs. 51st). The destination ranks worst when it comes to disposable household income. Almost half the expats there (45%) disagree with the statement that it is enough to lead a comfortable life (vs. 27% globally). Only 29% would say it is more than enough (vs. 44% globally).

Close to double the global average rate the cost of living in New Zealand negatively (64% vs. 35% globally) — 17% even say it is very bad (vs. 8% globally). Households in New Zealand continue to feel the pressure of rising inflation rates. According to the Consumer Price Index measurements, the inflation rate overall was up 6.7% in March 2023.

Norway also joins the bottom 3 of the Personal Finance Index in 2023. The cost of living is a major concern: 62% of expats rate it negatively, which is close to double the global average of 35%. Over one in five (23%) even say it is very bad (vs. 8% globally). High costs also mean incomes only take you so far: 37% find their disposable household income is not enough to lead a comfortable life in Norway (vs. 27% globally). Only 36% say it is more than enough, which is below the global average of 44%. Overall, less than half (49%) are satisfied with their financial situation (vs. 58% globally). According to the Norwegian central bank, the Norwegian krone has been one of the worst-performing currencies in 2023 so far, leading to increasing inflation rates.

“Everything in the UK is expensive. The income I get after taxes does not suffice.” – Indian expat

Expats continue to be unhappy with their finances in the United Kingdom (51st out of 53 countries). Less than half (44%) are satisfied with their financial situation (vs. 58% globally). And more than half (51%) rate the cost of living negatively, compared to 35% globally. The United Kingdom has been dealing with high inflation rates since 2022, but food inflation hit a record high of 15.7% in April 2023.

Trends in the Top 10

- Vietnam

- Mexico

- Philippines

- Thailand

- Malaysia

- Indonesia

- Colombia

- Panama

- India

- China

Destinations in Asia continue to dominate the top 10 in the Personal Finance Index in 2023, though there are some small shifts. All of the seven Asian countries here perform well across the different factors of the index, with China the only exception regarding cost of living. China does make up for its 18th place for this factor with higher incomes, though — only 37% of expats have a gross yearly income of less than 50,000 USD (vs. 53% globally). For all Asian destinations, one of the main reasons for moving is that expats are sent by their employer — this factor is the highest in India with 20%.

Colombia (7th) and Panama (8th) are newcomers to the top 10, kicking Taiwan and Portugal to a close 11th and 12th spot. Together with Mexico, the three destinations in Latin America perform similarly with very good results across all three factors of the index. The exception to this is Panama’s 15th place for cost of living. However, incomes are again higher — only 36% of expats there have a gross yearly income of less than 50K USD, compared to 53% globally.

Trends in the Bottom 10

- Australia

- Estonia

- Qatar

- Denmark

- Canada

- Ireland

- Singapore

- United Kingdom

- Norway

- New Zealand

Singapore (50th), just escaping a bottom 3 spot, might be the exception to Asian destinations performing well in this index. Expats struggle with the high cost of living: close to three-quarters (74%) rate it negatively (vs. 35% globally).

The bottom 10 includes five destinations in Europe: Norway (52nd), the United Kingdom (51st), Ireland (49th), Denmark (47th), and Estonia (45th). For expats in Norway, the UK, Ireland, and Denmark, the struggle with high costs is real: between 51% and 64% are dissatisfied with this factor (vs. 35% globally). Expats in Estonia, on the other hand, rate the country last place when it comes to satisfaction with their financial situation.

In Australia, over a third (35%) say their disposable household income is not enough to lead a comfortable life (vs. 27% globally). Expats in Canada and Qatar are also unhappy with this factor: 40% and 38% are dissatisfied, compared to a global average of 27%.

The Biggest Winners

With an improvement of 19 places in the ranking, Bahrain made impressive progress compared to 2022. The country managed to leave the bottom 10 of the Personal Finance Index behind and scores 27th place in 2023. Almost half the expats there (48%) now rate the cost of living favorably (vs. 44% globally). In 2022, only about a third (34%) shared that opinion. Just over half of expats in Bahrain (52%) are also satisfied with their financial situation (vs. 58% globally), which is a massive improvement compared to the 39% it had in 2022.

The second-biggest winner, Greece, has risen an equal 19 places to rank 21st out of 53 in the 2023 Personal Finance Index. Greece continues to have its best performance when it comes to the cost of living: almost six out of ten expats (58%) rate this factor favorably (vs. 44% globally and 48% in 2022). The country still ranks in the bottom 10 when it comes to disposable household income (46th), though. Just 33% say it is more than enough to live a comfortable life (vs. 44% globally). However, expats are more satisfied with their financial situation overall. In 2023, over half (56%) rate this factor positively (vs. 58% globally), compared to 51% in 2022.

The Biggest Losers

The biggest loser, Singapore, has dropped 31 places in the Personal Finance Index, entering into the bottom 5 (50th out of 53). In 2022, the city-state still ranked 19th out of 52 countries. With skyrocketing prices, it is no surprise that almost three-quarters of expats (74%) rate the cost of living negatively (vs. 35% globally). Luckily, incomes still seem to match: 75% rate their disposable household income as enough or more than enough (vs. 73% globally). However, in 2022 almost nine in ten (87%) shared that opinion. Overall, 57% of expats are satisfied with their financial situation (vs. 58% globally), which is a notable drop compared to the 75% in 2022.

Estonia plummeted 20 places, falling from 25th out of 52 countries in 2022 to a 45th rank out of 53 destinations in 2023. The biggest contribution to its current rank is the fact that close to a third of expats (32%) are unhappy with their financial situation (vs. 22% globally), and only 42% give it a positive rating (vs. 58% globally). In 2022, this result was still much closer to the average (57% vs. 60% globally). In terms of income, 74% earn 50,000 USD or less per year (vs. 53% globally). And in 2023, an increased percentage of expats rate the cost of living in Estonia negatively (36% vs. 31% in 2022).

Full Ranking

Further Reading

- Expat Insider 2023: Get the full PDF report

- RNZ News — New cost of living figures show who it’s hitting hardest

- CTV News — Norway central bank raises rates, worried by inflation, currency

- The Business Standard — UK food inflation hits record high in April

- Expats Feel Secure with Their Finances in Vietnam

- Mexico Is the Best Country for Expats (Again)

- New Zealand Ranks Last Worldwide for Expats’ Personal Finances

- Finland Outperforms Sweden, Denmark & Norway in the Eyes of Expats

- Work among the Few Highlights for Expats in the United Kingdom

- Expats Love Their Social Life in Bahrain

- Expenses Overshadow the High Quality of Life in Singapore

- Personal Finance Index 2022: Where Expats’ Finances Go a Long Way (and Where They Don’t)

Advertisement

Join InterNations

The community for expats worldwide

Download